The Market Research industry is lagging behind AdTech and MarTech… ResTech to the rescue!

by Hannu Verkasalo, Swash Advisor

The Market Research industry is lagging behind AdTech and MarTech… ResTech to the rescue! — Part 2/3

by Hannu Verkasalo, Swash Advisor

If you haven’t already, read the first edition of this series by Hannu here.

Business models in Market Research (MR) have not evolved much in recent decades; customers pay for respondents, they pay annual service fees that are fixed for many years to come and not related to the customers’ own revenues, they commission research projects, and so on.

The majority of sales in MR are still primarily done by humans, not taking place in programmatic or AI-driven environments. As a result, there is also a significant lack of standardisation for the items of trade (datasets, respondents, information flows).

If you take a look at these same elements in, say, the world of AdTech, there have been many advances in standardisation, including things like:

- Ad formats

- Creative types

- Exposure events

- Banner modules

- Ad types

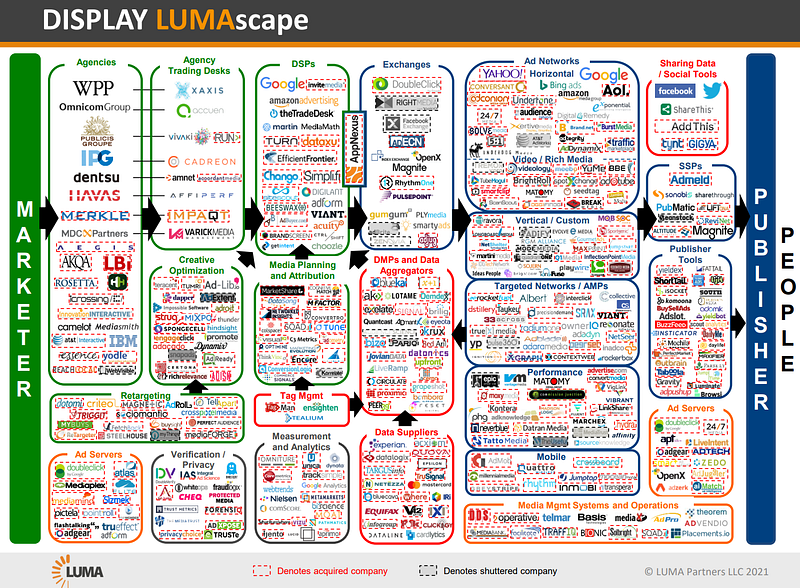

A healthy and well-developed tech ecosystem with multiple layers (see the LUMAscape from 2021 below) has emerged in AdTech to effectively create and manage both supply and demand, and handle automatic and programmatic transactions on a global scale every single second!

While the crypto industry and blockchain technology were born to challenge older, more abrasive methods and business models within a variety of industries (although so far dominated by finance), not much of this innovation has spilled into MR just yet.

While the monopolistic giants of MR have definitely had a negative impact on the rate of innovation, the overall mindset and lack of suitable venture capital investments (or even ideas worth being backed by VC) have also contributed to the old-fashioned nature of the industry.

There have been no major new openings in terms of business model innovation, and most of the companies in operation are focused on incremental, rather than radical, re-engineering of technologies or operations in MR.

From a technical standpoint, we are yet to see a true attempt at open-source innovation in MR. We also have not yet witnessed wide-scale adoption of APIs that build and enhance interoperability within MR. Note the contrast of this compared to MR’s shiny cousin, AdTech, which boasts a plethora of APIs that fuel the entire ecosystem.

Furthermore, there are no centralised platforms or marketplaces that provide liquidity, speed, back-office functions and standardisation for trading data, information, or services in MR. Many of the MR companies as we know them today are more like black boxes — there is limited transparency into the ways they operate, work, or how they collect or transform data into information.

Methodologies and internal processes have remained top secret, private, and with very little transparency. Even data collection, where these businesses should be super focused on doing their own part well, has seen little effort to improve or innovate with often dire consequences.

Take for example the role of privacy compliance. In just the last few years, there have been many major scandals including the likes of Jumpshot, Facebook and ComScore.

Finally, as with all industries, MR regularly sees people circulate from one company to another. This is to be expected, but there is not much external insight or brainpower being added to the mix, ready to shake up the industry foundations!

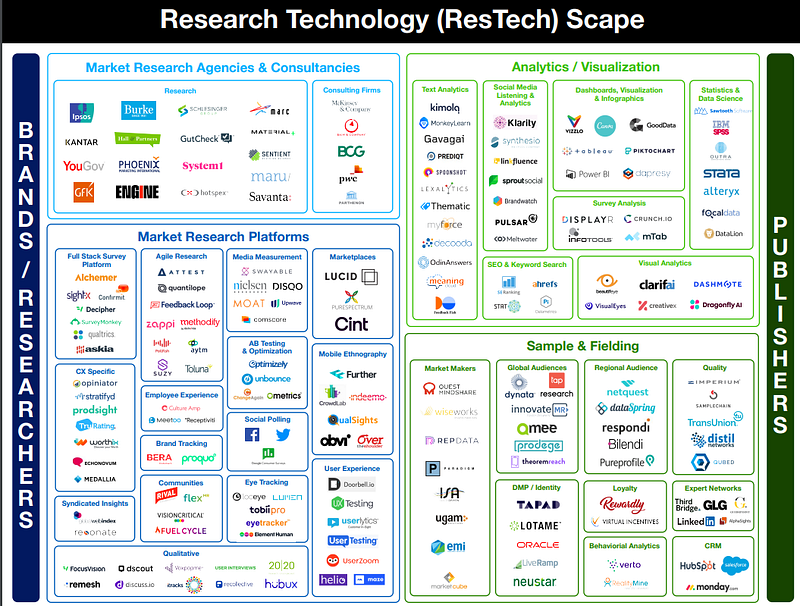

The current state of innovation in Market Research and the emergence of ResTech

Because of the many reasons listed above, until today, the MR industry is a fairly slow-moving, not very exciting beast. Especially when considering the business models and technologies at play.

There has been little-to-no adoption of mega-trends like AI/ML, platform-thinking, subscriptions, automation, market places, blockchain, crypto, having any impact on MR.

However, there is one exception.

In the case of panels, we have witnessed the emergence of panel exchanges, which have entered the industry over the past decade to connect hundreds of small and focused (geographically, data collection wise, or simply in terms of resources) panel companies together into a panel exchange, which can then be used by buyers.

Buyers need to access panellists in a multitude of ways, in either a time-critical or non-critical fashion, and either manually or automatically, in a programmatic manner.

There used to be two such kinds of companies operating at a larger scale — CINT and Lucid. However, they are now both part of CINT after the acquisition of Lucid. In fact, the founder of Lucid, Patrick Comer, was probably one of the first to start talking about ResTech!

This same ideology has not expanded to other areas of MR, like data buying or selling, audience ratings, variety of enterprise/consumer MR models, panel operations or building etc. Even though Patrick has drawn the first version of this so-called ResTech map, it is still naive to think that this would be a technically vibrant, rapid-paced ecosystem.

Unlike in AdTech, the companies in these grids, with a few exceptions, do not think they are operating in a broader ResTech ecosystem…

So, how do we tackle these challenges and really help the MR industry move forward, accelerate, and radically change or reset itself?

One way to think about this is to spur challenging new ventures forward. Those which aim to re-think and re-implement many of the processes or business layers discussed above, and to push for modularisation and more open innovation, dismantling the monopolistic-leaning tendencies of MR.

Written by Hannu Verkasalo; Swash Advisor and expert in the field of data analytics, Market Research & big data for 20 years.

About Swash

At Swash, if it’s your data, it’s your income.

Swash is an ecosystem of tools and services that enable people, businesses, and developers to unlock the latent value of data by pooling, securely sharing, and monetising its value.

- People share their data to earn while retaining their privacy.

- Businesses access high-quality, zero-party data in a sustainable and compliant way.

- Developers set up and build systems within a collaborative development framework with ease.

As the world’s leading Data Union, Swash is reimagining data ownership by enabling all actors of the data economy to earn, access, build and collaborate in a liquid digital ecosystem for data.

Join the biggest data movement in Web 3:

Twitter | Telegram | Reddit | LinkedIn | Website | DAO Ignition

Nothing herein should be viewed as legal, tax or financial advice and you are strongly advised to obtain independent legal, tax or financial advice prior to buying, holding or using digital assets, or using any financial or other services and products. There are significant risks associated with digital assets and dealing in such instruments can incur substantial risks, including the risk of financial loss. Digital assets are by their nature highly volatile and you should be aware that the risk of loss in trading, contributing, or holding digital assets can be substantial.

Reminder: Be aware of phishing sites and always make sure you are visiting the official https://swashapp.io website. Swash will never ask you for confidential information such as passwords, private keys, seed phrases, or secret codes. You should store this information privately and securely and report any suspicious activity.