The Market Research industry is lagging behind AdTech and MarTech… ResTech to the rescue!

by Hannu Verkasalo, Swash Advisor

The Market Research industry is lagging behind AdTech and MarTech… ResTech to the rescue! — Part 1/3

by Hannu Verkasalo, Swash Advisor

Swash is a Web 3 native, blockchain-based, clickstream data company, and entering the market research industry with a number of unique solutions and a freshly built panel with online behavioural data collection.

For many, it’s unclear what market research actually is, where it comes from, and what type of opportunities and challenges it faces. Where does Swash fit within all of this? In this series of blogs, I will address these topics in a sequence. In this first blog, I discuss the background of the market research industry, its structure, and its function in the overall business landscape.

A brief history of Market Research (and why you should care)

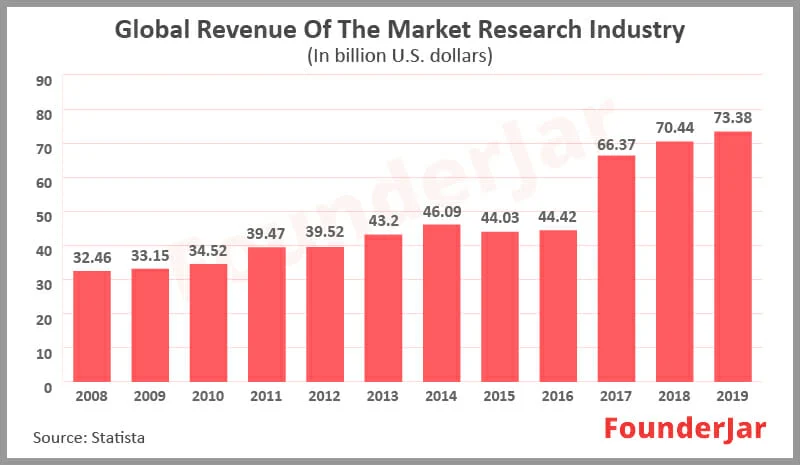

Market Research (MR) is a big industry and quickly growing. As defined by Nielsen/Wikipedia, “Market research is an organised effort to gather information about target markets and customers: know about them, starting with who they are.”

For the purposes of this post, MR constitutes the overall industry including companies, platforms, operations, technologies, techniques, and mindsets involved in collecting data, turning that data into information and, potentially, actions that relate to either businesses or consumers and their needs, behaviours, and background. This is how I perceive and think about market research.

While the industry can be formally thought to have been born in the 1920s, with George Gallup and his polls taking shape for the first time, it really began with more formal dimensions in the latter half of the 20th century with companies emerging with focus on different subsegments of the MR industry, like Nielsen/Arbitron for audience ratings, NPD and GFK for purchase tracking, Ipsos, TNS and others for all-service MR consulting.

The turn of the millennium saw further fragmentation, with specialised companies surfacing to build and operate panels, building focused MR data models for specific use cases (like product packaging), and more venture funding being poured into the industry.

Currently, the total global MR revenue is close to hitting $100B USD. With such prevalence in the market, it should be considered alongside its neighbouring industries, including marketing, advertising, and creative industries.

Product and service offerings — from ice cream to vacations/holiday packages, medicine to consumer electronics — have expanded rapidly in variety and quantity. This, combined with consumers entering the age of consumption (i.e. welcome to the age of consumerism), demands and disposable income worldwide has also grown, leading to an unprecedented demand for market research.

Over the past two decades, the market research industry has adopted many online research methods, to either complement or replace older methods of face-to-face interviews, paper polls, and telephone interviews.

However, the technical and business evolution in MR has largely lagged behind other areas of marketing, especially in comparison to marketing technologies (MarTech) and advertising technologies (AdTech).

In fact, there is currently no widespread momentum or availability of market research technologies (which I’ll refer to as ‘ResTech’ from hereon), but there are a select few solutions well-poised to lead the way… But first, let’s consider why MR is the tortoise in the race.

What does a Market Research business look like?

In order to understand the potential business and technical innovation challenges in MR and why ResTech deserves a more aggressive and widespread push, let’s take a closer look at the different businesses and techniques included in MR.

First, most market research is focused on turning some kind of data into information (i.e. data with meaning), further into knowledge (i.e. understanding what the information says, then interpreting it), and using this knowledge to make decisions and take action (for example, to derive new segmentation models to targeted marketing campaigns or creating new product categories to better align with consumer needs).

Now, there is some — though not very competitive or modularised — segregation within the MR industry among the active business players, when it comes to these different phases or processes defined above. For example, there are many sub-segments in the industry that are focused solely on data collection, or tooling related to it.

There are various panel companies that are focused on building audiences (a set of panellists) with opt-in consent to participate in market research. These companies provide access to these panellists for companies that want to collect data — this could include the variety of survey research companies that conduct online or offline (snail mail, telephone interviews, focus groups) surveys with panellists, or some other companies that want to use the panellists to collect things like passive behavioural data from their TVs, streaming set-top boxes, mobile devices, or desktop or laptop computers.

The data collected by these companies can be further used by the companies themselves (particularly when it comes down to giants like Nielsen or Kantar) to:- Derive information — Determine metrics- Create derivative products like those used for audience ratings and measurement (who is watching or using and what)- Campaign measurement (how many people were exposed to ad X on channel Y)- Media planning (how to reach a certain audience) — Creative testing (what content resonates with a certain audience)- Product concept or packaging testing- Satisfaction ratings

… to name a few. Some companies, like Nielsen, are HUGE and control many of the processes from data collection to providing ready-made B2B services to their enterprise customers.

Usually, the above use cases — typically materialising in specific MR products or services — are built by respective individual companies, outside of the companies collecting the raw data needed to fuel them.

In some cases, there are also tech providers who license technology (such as SW for collecting passive data) to companies who operate or use panels to collect data. A wide variety of companies exist in MR, from major monopolies which are vertically and also horizontally integrated (e.g. Nielsen, ComScore, Kantar Media), to smaller enterprises that have either vertical focus (e.g. data collection vs. building end-customer dashboards for insights) and/or horizontal focus (e.g. audience ratings vs. satisfaction polls vs. product concept testing).

Finally, there are a variety of consulting houses who are not focused on their own data collection, neither do they have standardised services or products, but who instead do so-called custom research — answering questions and research tasks from their end-customers in a custom research or project-based fashion, by providing almost consulting-type services or doing one-off projects to address these needs.

There are also integration companies, even provided by the global consulting/tech giants like IBM, McKinsey, and Accenture, which aim to take some of these MR-specific offerings or elements and then combine that with other business activities, in which advertising planning and execution are among some of the more advanced efforts.

The current state of ResTech and a glimpse of what’s to come

While the MR industry has slowly evolved, and some of the above business and operational layers have emerged, the industry is still far from being technically advanced.

In fact, if you ask anybody senior in the industry, forgetting about any externals (like venture capitalists who have assessed or invested into businesses within MR, or executives who have spent any time in, for example, AdTech), it is clear that the industry is still extremely old-fashioned!

I personally have been involved in both corporates and start-ups in the MR world for almost two decades, and have witnessed this lack of technical progress firsthand. Compared to my understanding and conclusions from many other areas of tech, the MR industry is still extremely slow in adopting new methods, technologies, platforms, and mindsets. The people, the culture, the overall spirit is not super tech-centric, but is rather more focused on sustaining stability, standard methods of doing things, and with a low appetite for risk-taking.

What’s more, the MR industry is still mostly controlled by huge, global, multi-national, multi-product monopolistic giants, like Nielsen (formerly Nielsen Global Media), Nielsen IQ (formerly Nielsen Connect), Kantar, Ipsos, GFK, IQVIA (formerly IMS Health), who essentially rule the world.

In some product categories, like audience ratings, there are even country-specific JICs (Joint Industry Committees), which decide on the national standard for providing audience ratings data and services to the country’s customers for many years to come, effectively blocking any new entrants (hence stifling technical innovation or business challengers) from the market for years to come!

In brief, we are still yet to witness the widespread creation, adoption, and success of technically advanced and open innovation ecosystems in market research. There has been no such thing as ResTech (Research Technologies) being born in market research yet.

Until now.

Stay tuned for parts 2 and 3 of this series, coming soon on the Swash blog.

Written by Hannu Verkasalo; Swash Advisor and expert in the field of data analytics, Market Research & big data for 20 years.

About Swash

At Swash, if it’s your data, it’s your income.

Swash is an ecosystem of tools and services that enable people, businesses, and developers to unlock the latent value of data by pooling, securely sharing, and monetising its value.

- People share their data to earn while retaining their privacy.

- Businesses access high-quality, zero-party data in a sustainable and compliant way.

- Developers set up and build systems within a collaborative development framework with ease.

As the world’s leading Data Union, Swash is reimagining data ownership by enabling all actors of the data economy to earn, access, build and collaborate in a liquid digital ecosystem for data.

Join the biggest data movement in Web 3:

Twitter | Telegram | Reddit | LinkedIn | Website | DAO Ignition

Nothing herein should be viewed as legal, tax or financial advice and you are strongly advised to obtain independent legal, tax or financial advice prior to buying, holding or using digital assets, or using any financial or other services and products. There are significant risks associated with digital assets and dealing in such instruments can incur substantial risks, including the risk of financial loss. Digital assets are by their nature highly volatile and you should be aware that the risk of loss in trading, contributing, or holding digital assets can be substantial.

Reminder: Be aware of phishing sites and always make sure you are visiting the official https://swashapp.io website. Swash will never ask you for confidential information such as passwords, private keys, seed phrases, or secret codes. You should store this information privately and securely and report any suspicious activity.

Originally published at https://swashapp.io on March 24, 2022.